Table of Content

- How long do you have to wait between VA loans?

- VA Streamline Refinance (VA IRRRL): What Is It And How Does It Work?

- Oct Can I Use A VA Loan For A Second Home, Rental, Vacation Condo, or A Manufactured Home?

- VA Loan Certificate of Eligibility (COE)

- Can I get a Certificate of Eligibility for a VA direct or VA-backed home loan?

- Automatic Restoration of Entitlement

- Can I Get a VA Home Loan for a Vacation Property?

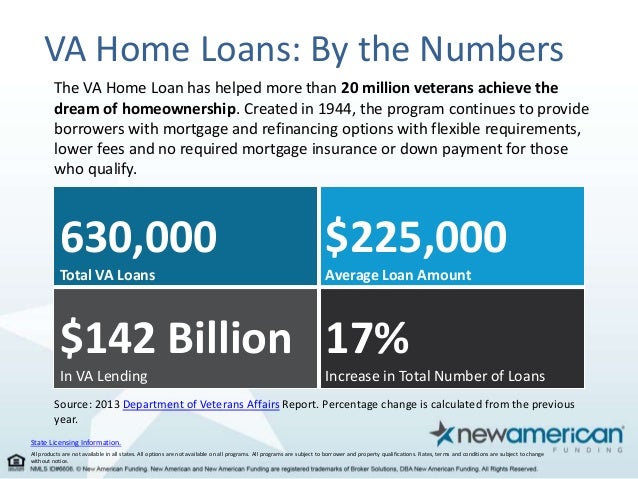

The basic intention of the VA home loan program is to supply home financing to eligible veterans and to help veterans purchase properties with no down payment. Refinancing with a VA loanmay be a good option if you’re looking to lower your monthly mortgage payments, take advantage of lower interest rates or use some of your home equity to cover various expenses. As a veteran, you took out a VA loan to purchase your first home, and you are still paying it back. There is a possibility that you may be eligible for a second VA loan if your eligibility is sufficient and your credit and income satisfy the lender when you move to a new primary residence.

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. At Bankrate we strive to help you make smarter financial decisions.

How long do you have to wait between VA loans?

But this entitlement may be restored to allow you to buy or build another home you intend as your primary residence. The occupancy issue applies no matter the circumstance you find yourself in with a VA loan to purchase property–you can’t buy a house you don’t intend to live in as your main home. That does not mean you can’t buy a multi-unit property and rent out the unused units, but the borrowers obligated on the mortgage are required to use the house they buy with a VA mortgage as their home.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. The property can’t be subject to any agreements that require the borrower to rent the property or give a management firm control over the occupancy and use of the property. If you’re planning to purchase a second home in the future, set up a meeting with your loan officer to determine a plan of action. We can help you determine next steps based on your unique scenario.

VA Streamline Refinance (VA IRRRL): What Is It And How Does It Work?

Under the VA loan program, the Veterans Administration doesn’t actually make home loans. Instead, it guarantees repayment of 25% of the value of mortgages that banks and other non-government lenders make under the program. The house you buy or build with a VA mortgage must be your primary residence within 60 days of closing in most cases. Those who serve enough time in uniform are eligible to apply for VA home loan benefits. For example, let's say you buy a home with a VA loan and then refinance into a conventional mortgage. At that point, if you're planning to hold onto the home rather than sell it, you could look to apply for the one-time restoration of entitlement to purchase again using your full VA loan entitlement.

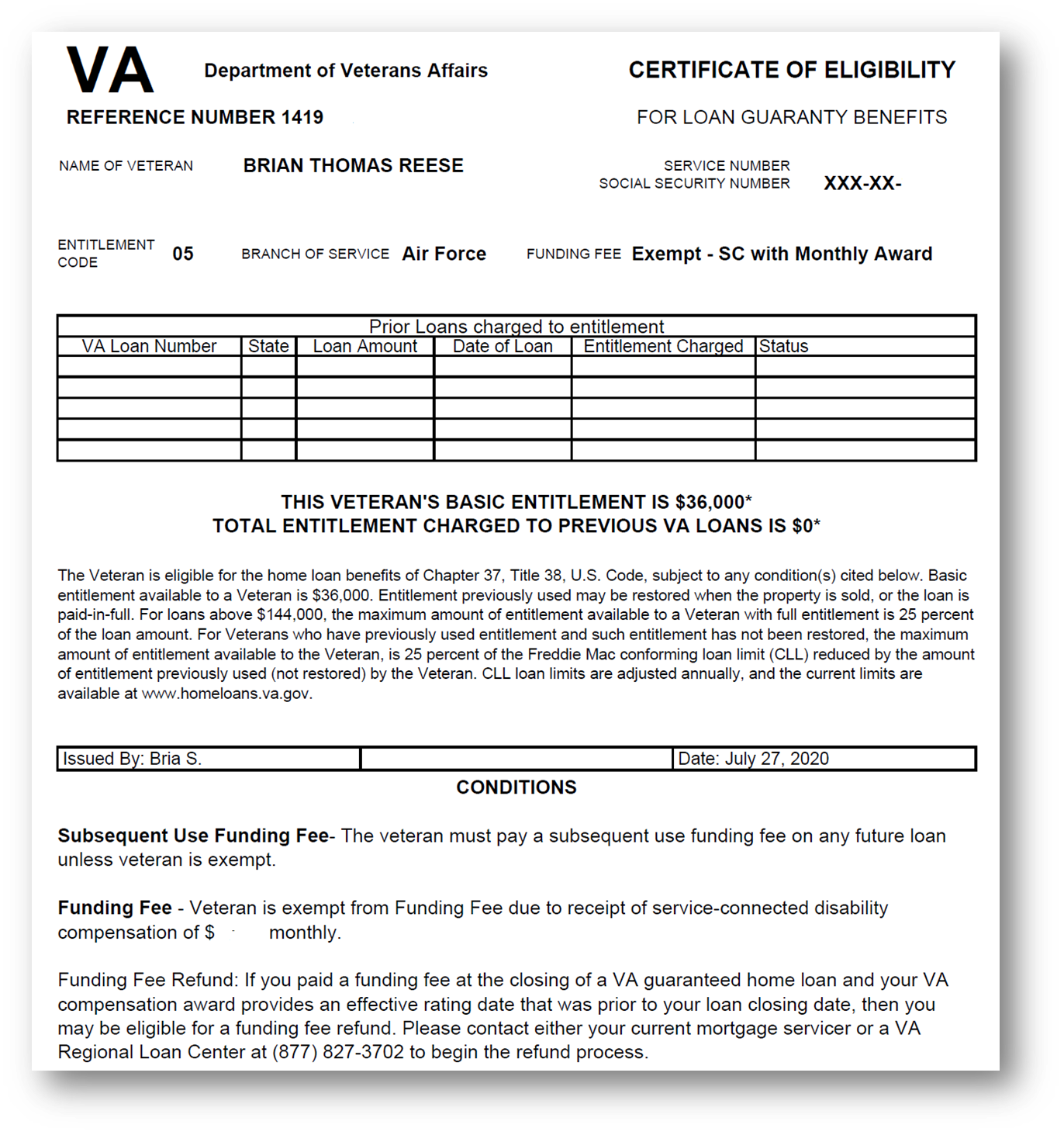

You are an eligible veteran who had a foreclosure or short sale but repaid the VA in full. You are an eligible veteran who has not used their home loan benefit. Each VA member has a specific amount of money they’re “entitled” to through VA loans. But not all VA members use all of their entitlement when they purchase a home.

Oct Can I Use A VA Loan For A Second Home, Rental, Vacation Condo, or A Manufactured Home?

This means you cannot legally purchase a home with a VA loan that you don’t intend to occupy for the majority of the year. Then you can either restore your entitlement or use your remaining entitlement to cover a new VA loan. In some cases, you can restore entitlement to obtain a cash-out refinance for the property you currently own.

To be sure a VA loan can be used in a particular circumstance, it’s a good idea to check with the regional VA office and discuss the situation. Buyers who have some of their basic entitlement remaining may be able to utilize that and avoid the minimum loan amount. You can ask a loan officer to go over your Certificate of Eligibility with you in more detail. For example, let’s say the limit where you want to buy again is $1,089,300.

Vacation Home

In New York State it is licensed by the Department of Financial Services. Please click here if you do not wish us to sell your personal information. You can use a second VA loan to get a second home – but there are stipulations you must follow. As with the second VA loan, you have to have entitlement available, and you’ll have to be financially eligible for another mortgage. If you take out a second VA loan, the funding fee is something to keep in mind. You’ll pay a higher funding fee if you plan to put down less than 5% on the home purchase.

In addition, a number of lenders charge a flat origination fee which can be anywhere around $50 or into the hundreds of dollars or more. More significantly, many lenders charge a closing fee as part of the loan which can be as much as 2%-5% of the loan value. Keep in mind that the mortgage lender makes a hard inquiry on your credit when you apply. Hard inquiries cause your credit score to take a small dip, so only try to get preapproved when you’re serious about putting in an offer on a home.

If the property is being converted, it’s a good idea to talk to your lender. The VA does not lend money but guarantees up to 25% of the loan; this guarantee is called an entitlement. The Veteran Loan program is designed for veterans who meet the minimum number of days of completed service. Some of the other eligibility requirement for the VA loan program and some specific home loan benefits include the length of service or service commitment, duty status and character of service.

The VA loan program is designed to help veterans and active service members purchase homes with no down payments and despite less-than-ideal credit scores and existing debt loads. Federal laws states veterans must plan to live in the home as their primary residence. Consider working with a financial advisor as you make decisions about mortgages for buying a second residence.

Consequently, as you’re not actually selling the original house in this scenario, options for restoring your entitlement narrow. With assumable mortgages, a qualified buyer can take over, or assume, the original borrower’s mortgage. For VA borrowers, this means that, rather than sell your home, you can find a fellow veteran with VA loan eligibility to take over your mortgage payments and interest in the property .